The Incredible Story behind the Collapse of the National Bank of Keystone

Posted by Jane Metters LaBarbara.September 4th, 2019

Blog post by Linda Blake, University Librarian Emerita

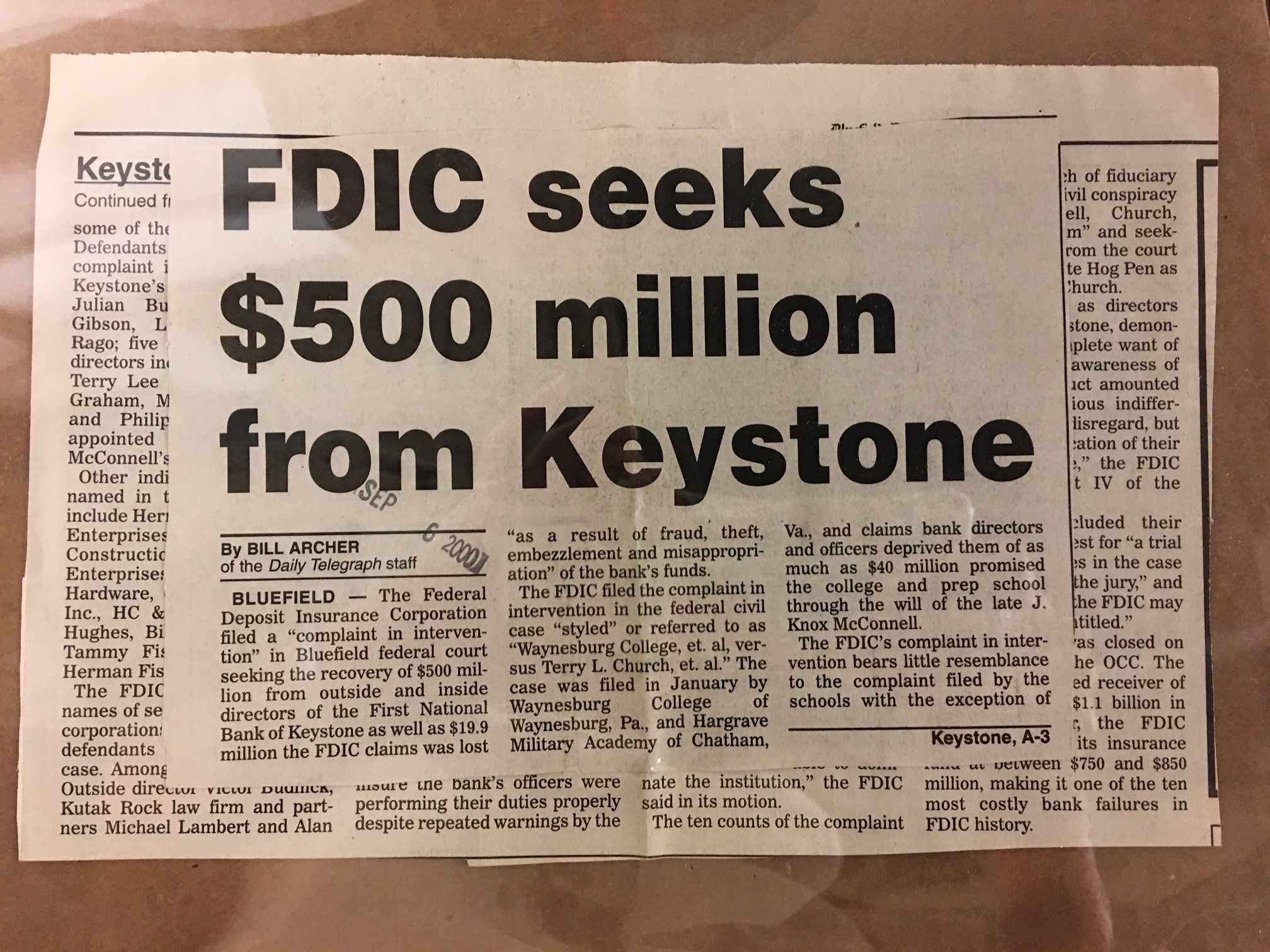

Twenty years ago, on September 1, 1999, a federal agency, the Office of the Comptroller of Currency (OCC), closed the National Bank of Keystone and turned it over to the Federal Deposit Insurance Corporation (FDIC).

Just weeks before, the good people of Keystone, West Virginia could have seen the removal of bank records from an old school building and witness their burial on the property of Terry Church, the head of the bank. Bank officials buried the records in an effort to cover up their inefficiency, corrupt and illegal practices, and the theft of millions of dollars. A month and a half after the bank closing, the FBI dug up the records, and so began the collection of evidence for the criminal and civil trials to follow.

The town of Keystone, with a population of about 500 at the time of the bank closing, was once a thriving coal community with an historically majority black population, but in 1999 it was the center of national attention as the story of the unprecedented collapse unfolded. The town of Keystone lost one of its major employers and some people lost their life savings.

The bank once heralded as one of the top-performing banks in the nation faced a deficit of $500 million between reported assets and actual funds. The FDIC estimated that the bailout cost the Bank Insurance Fund between $750 million and $850 million, making it one of the 10 most costly failures in history.

William “Bill” Archer, reporting for the Bluefield Daily Telegraph, documents the collapse of the bank and its aftermath in his papers which were recently processed in the WV and Regional History Center. Archer’s in depth reporting and research covered every aspect of the troubles at the Keystone Bank and then closely followed the subsequent court cases against the crooks who drained the bank of its funds and wreaked financial devastation on this small town. He also investigated the key characters in this unbelievable drama. They include Knox McConnell who came from Pennsylvania to run the bank in 1977 but died before the collapse in 1997; Terry Church who took over the bank after McConnell’s death; Billie Cherry, McConnell’s companion who was mayor of Keystone at the time of the bank closing; and an assembly of bank employees, relatives of the major players, government officials, accountants, and many more.

Knox McConnell, Keystone Bank president, and the women known as Knox’s Foxes. From left to right: Billie Cherry, two unnamed women, Knox McConnell, Terry Lee Church, Melissa Quesenberry

If burying bank records in broad daylight seems fantastical, other side stories from the Keystone Bank collapse include:

- obstructing the investigation by federal agencies with shenanigans including threats and intimidation of examiners, stonewalling, falsifying documents, and involving U.S. Congressmen

- incompetence and in-fighting of the two oversight federal agencies, the OCC and the FDIC

- forging a false codicil to a will to gain control of McConnell’s wealth

- Waynesburg College’s battle to get the endowment left in McConnell’s will

- money laundered through a bingo parlor in Alabama and a motorcycle shop called Hog Pen and owned by Terry Church’s husband

- Keystone as precursor of the larger 2008 big bank financial collapse

- international intrigue as off shore lenders became involved

- criminal involvement of a prestigious law firm and accounting firm including an accountant named Harry J. Potter

- a U.S. Congressional hearing on how the government failed to prevent the disaster

- and more, more, more

It’s all here for study and investigation in William Archer’s papers. Additional sources in the Center include a book, Anatomy of a Bank Scandal: the Keystone Bank Failure—Harbinger of the 2008 Financial Crisis by Robert S. Pasley, a former attorney for the OCC; newspaper microfilm files for the Bluefield Daily Telegraph and other newspapers and journals; and the U.S. Department of the Treasury’s investigation freely available online.